student loan debt relief tax credit 2020

Should I consider bankruptcy to. Beginning in the 2022 tax year employers will be provided with a 50 tax credit of up to 2625 per year for payments made on a student loan.

Is Taking On More Student Debt Bad For Students Econofact

For Maryland Residents or Part-year Residents Tax Year 2020 Only.

. Everyone is always looking for ways to reduce their tax liabilities but many people have no idea that this significant tax deduction is widely available. The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings income tax credit for Maryland. The government has powerful collections tools that allow federal lenders and debt collectors to garnish wages intercept federal tax.

The enhanced property tax credit is a flat percentage of 585 for the local property tax credit and 315 for the state tax credit in each of the first 24 tax years. If youre paying 400 a month in student loans which is over the credit limit youll receive the following in credit. Massachusetts Ohio and Vermont are considering similar legislation in 2020.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and. Give information on the new universities or universities your went to that correspond with the student andor graduate education loan obligations you should include in that it application.

Employees must be a state resident recent college graduate and employed full time in the state. 2018-39 provide the following relief. 1 the Internal Revenue Service IRS will not assert that these taxpayers must recognize gross income resulting from the discharge of these Federal and private student loans.

200 x 12 months 2400. Student loan Debt settlement Income tax Credit to own Income tax Year 2020 Details. You must provide an email address where MHEC.

The application is free. This application together with instructions that are related for Maryland residents who would like to claim the scholar Loan credit card debt relief Tax Credit. 6 Research shows that post.

If you prefer to complete a hard copy application instead of applying online you may mail it to. Student Loan Credit Card Debt Relief Tax Debt for Income Tax 12 Months 2020 Information. The AOTC offers a credit of 100 on the first 2000 of qualifying educational expenses and 25 on the next 2000 for a maximum of 2500.

Meanwhile the issue continues to shine light on the rising costs of going to college. It requires a completely separate form attached to a Form 1040 tax return and receipt of a Form 1098-T from the institution where the student was enrolled. Complete the Student Loan Debt Relief Tax Credit application.

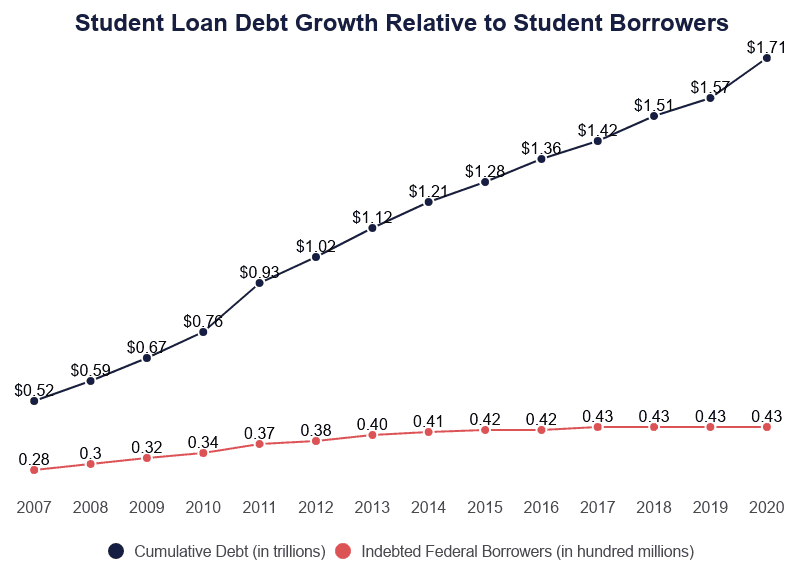

The first day you can apply for the 2020 tax-year credit is July 1 2021. Biden has already ruled out canceling 50000 worth of debt but 10000 of forgiveness is still on the table. There are more than 45 million American borrowers who collectively owe nearly 16 trillion in student loan debt a burden amounting to nearly 8 of national income.

Maryland Higher Education Commission Attn. To be considered for the tax credit applicants must complete the application and submit student loan. Instructions are at the end of this application.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return. From July 1 2022 through September 15 2022. Currently owe at least a 5000 outstanding student loan debt balance.

New Education loan Credit card debt relief Tax Credit is a program created less than 10-740 of your Taxation-General Article of the Annotated Code out of Maryland to include a tax credit to possess Maryland citizen taxpayers exactly who make qualified undergraduate and you mayotherwise graduate student loan costs into money out-of a certified school or college or. College tuition and fees were about 170 more expensive in 2021 than in 2001 Tejersen cites in a new book on reducing higher education bureaucracy. Student Loan Debt Relief Tax Credit Application.

Student Loan Debt Relief Tax Credit 6 North Liberty Street 10th floor Baltimore Maryland 21201. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate degree ie. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt at the time of applying for the tax credit. If youre paying 200 a month in student loans youll receive the following in credit. 5 Forty-six percent of federal student loan borrowers surveyed said they expected to struggle making their payments once forbearance relief ended under the CARES Act.

In 2019 IRS tax law allows you to claim a student loan interest deduction of 2500 on your 2018 Taxes as long as you and your student loans meet certain eligibility criteria. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. If the credit is more than the state tax liability the unused credit may be carried forward for the next five 5 taxable years.

If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference. The Maryland Higher Education Commissionmay request additional documentation supporting your claim for this or subsequent tax years. Dont dump a loan application you currently started.

2 the IRS will not assert that these taxpayers must increase their gross income by the amount. Federal student loan default can be devastating for borrowers. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will get a 200 refund.

367 x 12 months 4404. The payments will not be considered a taxable benefit for the employee. Under the CARES Act employers can contribute up to 5250 toward a workers student debt on a tax-free basis through the end of 2020.

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

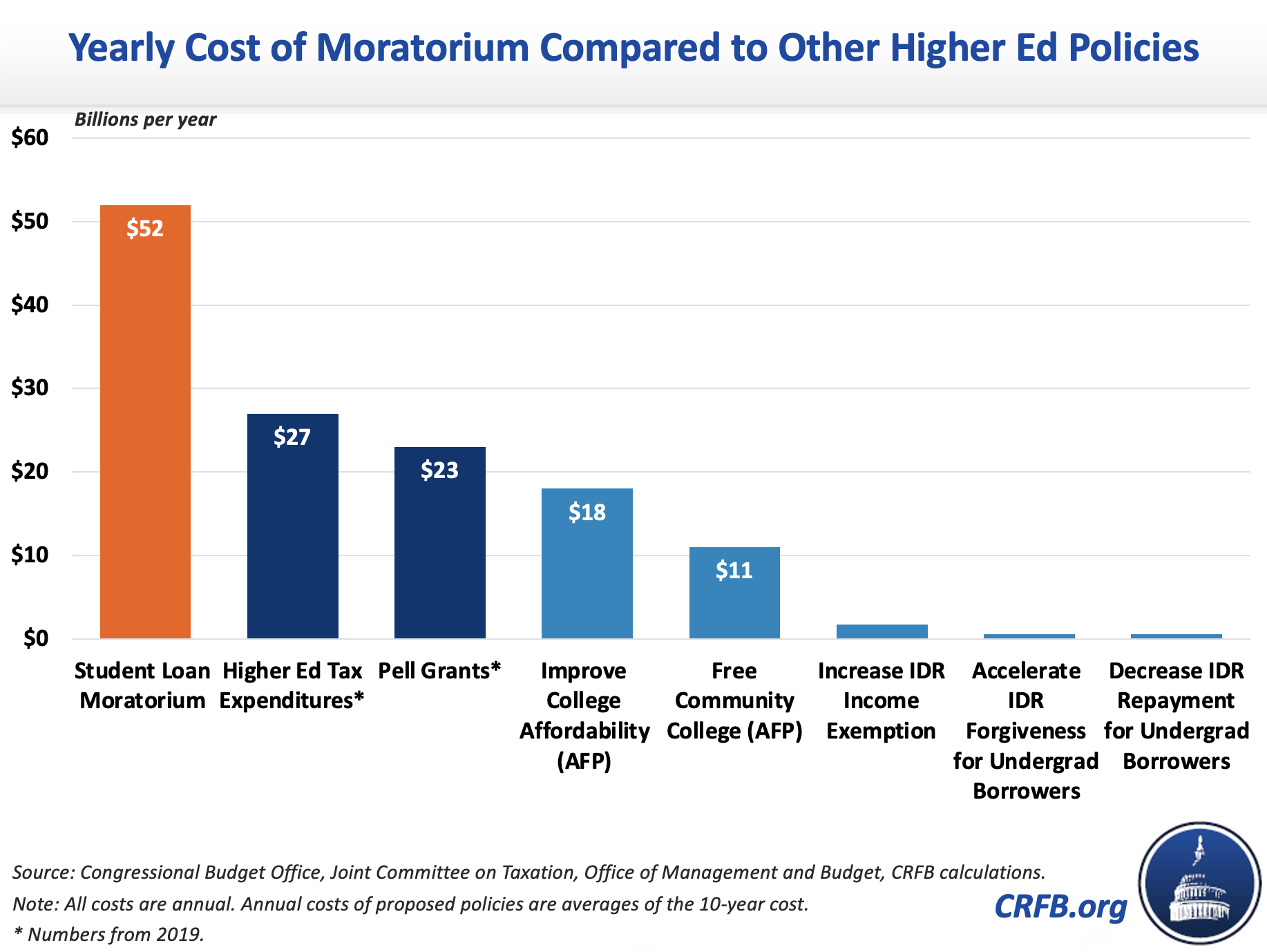

It S Time To Wind Down The Student Loan Moratorium Committee For A Responsible Federal Budget

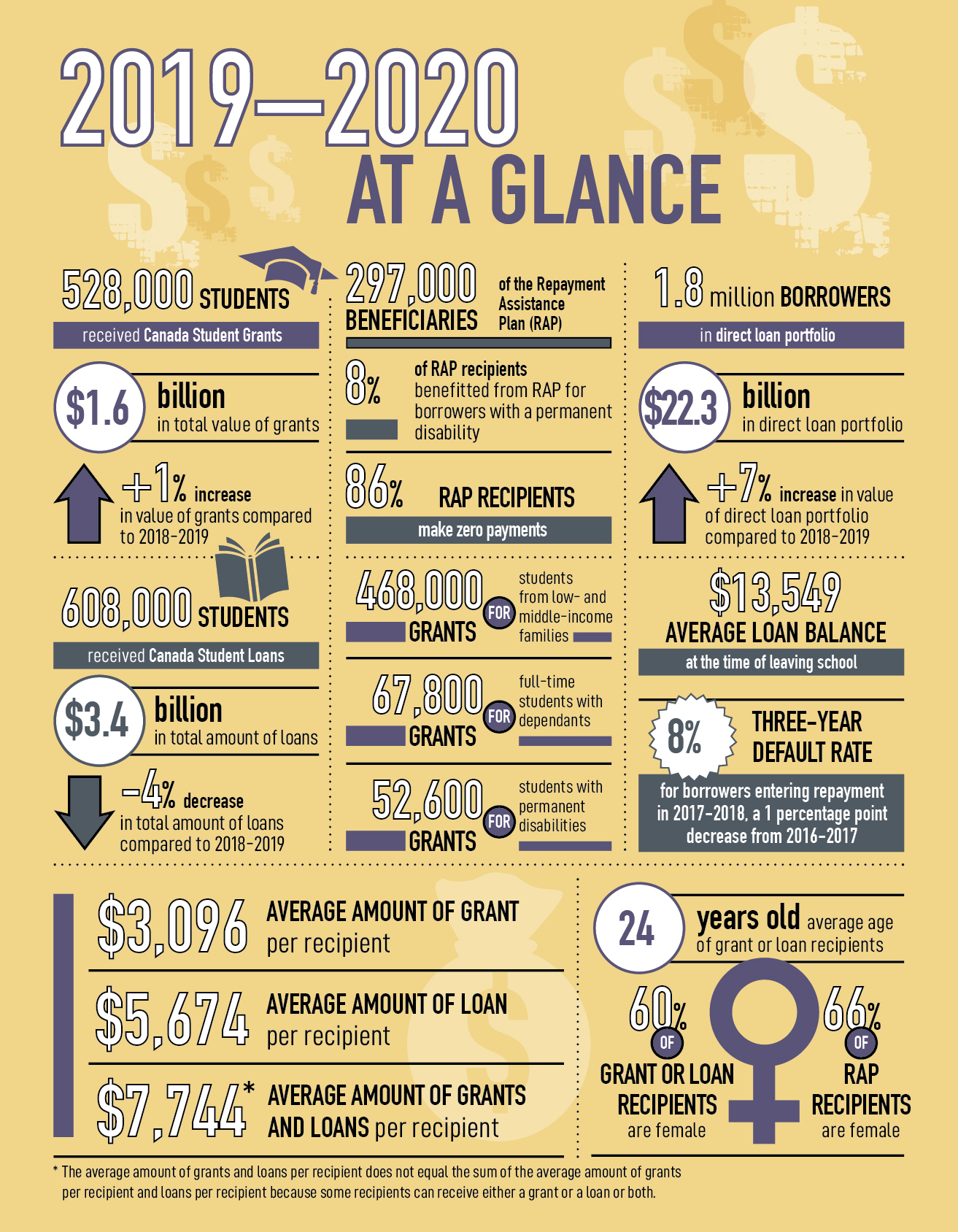

Student Loan Forgiveness In Canada Loans Canada

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

What Are The Pros And Cons Of Student Loan Forgiveness

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Is The Current Student Debt Situation People S Policy Project

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Student Loan Debt Crisis In America By The Numbers Educationdata Org

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

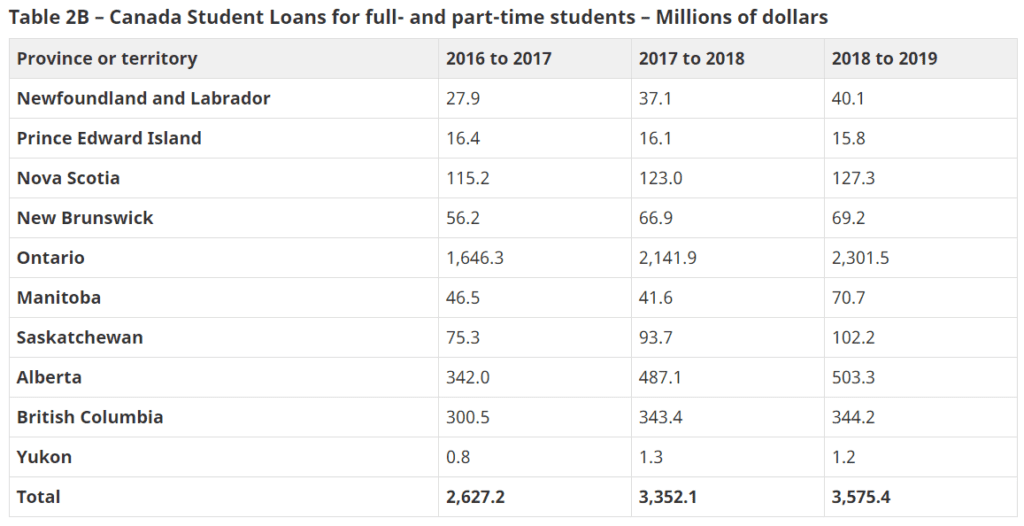

2019 To 2020 Canada Student Financial Assistance Program Statistical Review Canada Ca

The Case Against Student Loan Forgiveness

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

Promote Economic And Racial Justice Eliminate Student Loan Debt And Establish A Right To Higher Education Across The United States Equitable Growth